Discount factor 10 for 8 years. Discount rate formula

Do you know what discounting means? If you are reading this article, then you have already heard this word. And if you haven’t yet fully understood what it is, then this article is for you. Even if you are not going to take the Dipifr exam, but just want to understand this issue, after reading this article, you can clarify for yourself concept of discounting.

This article, in accessible language, talks about What is discounting? It shows the technique of calculating discounted value using simple examples. You will learn what a discount factor is and learn how to use

The concept and formula of discounting in accessible language

To make it easier to explain the concept of discounting, let's start from the other end. Or rather, let’s take an example from life that is familiar to everyone.

Example 1. Imagine that you went to the bank and decided to make a deposit of $1,000. Your 1000 dollars deposited in the bank today, at a bank rate of 10%, will be worth 1100 dollars tomorrow: the current 1000 dollars + interest on the deposit 100 (= 1000 * 10%). In total, after a year you will be able to withdraw $1,100. If we express this result through a simple mathematical formula, we get: $1000*(1+10%) or $1000*(1.10) = $1100.

In two years, the current $1,000 will become $1,210 ($1,000 plus first year interest $100 plus second year interest $110=1100*10%). The general formula for increasing the contribution over two years: (1000*1.10)*1.10 = 1210

Over time, the amount of the contribution will continue to grow. To find out what amount is due to you from the bank in a year, two, etc., you need to multiply the deposit amount by the multiplier: (1+R) n

- where R is the interest rate, expressed in fractions of a unit (10% = 0.1)

- N – number of years

In this example, 1000 * (1.10) 2 = 1210. It is obvious from the formula (and from life too) that the deposit amount after two years depends on the bank interest rate. The larger it is, the faster the contribution grows. If the bank interest rate were different, for example, 12%, then after two years you would be able to withdraw approximately $1,250 from the deposit, and if we calculate more precisely, 1,000 * (1.12) 2 = 1,254.4

In this way, you can calculate the amount of your contribution at any point in time in the future. Calculating the future value of money in English is called “compounding”. This term is translated into Russian as “extension” or by tracing paper from English as “compounding”. Personally, I prefer the translation of this word as “increment” or “increase”.

The meaning is clear - over time, the cash deposit increases due to the increment (growth) of annual interest. In fact, the entire banking system of the modern (capitalist) model of the world order, in which time is money, is built on this.

Now let's look at this example from the other end. Let's say you need to repay a debt to your friend, namely: in two years you need to pay him $1210. Instead, you can give him $1,000 today, and your friend will deposit this amount in the bank at an annual rate of 10% and in two years withdraw exactly the required amount of $1,210 from the bank deposit. That is, these two cash flows: $1000 today and $1210 in two years - equivalent each other. It doesn't matter what your friend chooses - these are two equal possibilities.

EXAMPLE 2. Let's say in two years you need to make a payment in the amount of $1,500. What will this amount be worth today?

To calculate today's value, you need to go from the opposite: $1500 divided by (1.10)2, which will be equal to approximately $1240. This process is called discounting.

To calculate today's value, you need to go from the opposite: $1500 divided by (1.10)2, which will be equal to approximately $1240. This process is called discounting.

In simple terms, then discounting is determining the present value of a future amount of money (or more correctly, a future cash flow).

If you want to find out how much a sum of money you either receive or plan to spend in the future will cost today, then you need to discount that future amount at a given interest rate. This bet is called "discount rate". In the last example, the discount rate is 10%, $1,500 is the amount of payment (cash outflow) in 2 years, and $1,240 is the so-called discounted value future cash flow. In English, there are special terms to denote today's (discounted) and future value: future value (FV) and present value (PV). In the example above, $1500 is the future value of FV and $1240 is the present value of PV.

When we discount, we go from the future to today.

Discounting

When we build up, we move from today to the future.

Extension

The formula for calculating the present value or discounting formula for this example is: 1500 * 1/(1+R) n = 1240.

In general, the mathematical formula will be: FV * 1/(1+R) n = PV. It is usually written like this:

PV = FV * 1/(1+R) n

Coefficient by which future value is multiplied 1/(1+R)n called a discount factor from the English word factor meaning “coefficient, multiplier”.

In this discounting formula: R is the interest rate, N is the number of years from a date in the future to the current moment.

Thus:

- Compounding or Increment is when you go from today's date to the future.

- Discounting or Discounting is when you go from the future to today.

Both “procedures” allow us to take into account the effect of changes in the value of money over time.

Of course, all these mathematical formulas immediately make the average person feel sad, but the main thing is to remember the essence. Discounting is when you want to know the present value of a future amount of money (that you will need to spend or receive).

I hope that now that you have heard the phrase “concept of discounting,” you can explain to anyone what is meant by this term.

Is present value the discounted value?

In the previous section we found out that

Discounting is the determination of the present value of future cash flows.

Isn’t it true that in the word “discounting” you hear the word “discount” or discount in Russian? And indeed, if you look at the etymology of the word discount, then already in the 17th century it was used in the meaning of “deduction for early payment,” which means “discount for early payment.” Even then, many years ago, people took into account the time value of money. Thus, one more definition can be given: discounting is the calculation of a discount for prompt payment of bills. This “discount” is a measure of the time value of money.

Discounted value is the present value of the future cash flow (i.e., the future payment minus the “discount” for prompt payment). It is also called present value, from the verb “to bring.” In simple words, present value is future amount of money given to the current moment.

To be precise, discounted and present value are not absolute synonyms. Because you can bring not only the future value to the current moment, but also the current value to some point in the future. For example, in the very first example, we can say that $1,000 discounted to the future (two years from now) at a 10% interest rate is equal to $1,210. That is, I want to say that present value is a broader concept than discounted value.

By the way, in English there is no such term (present value). This is our, purely Russian invention. In English there is the term present value (current value) and discounted cash flows (discounted cash flows). And we have the term present value, and it is most often used in the sense of “discounted” value.

Discount table

I already mentioned a little higher discounting formula PV = FV * 1/(1+R) n, which can be described in words as:

Present value equals future value multiplied by a factor called the discount factor.

The discount factor 1/(1+R) n, as can be seen from the formula itself, depends on the interest rate and the number of time periods. In order not to calculate it each time using the discounting formula, use a table showing the values of the coefficient depending on the percentage of the rate and the number of time periods. It is sometimes called a "discount table", although this is not the correct term. This discount factor table, which are calculated, as a rule, accurate to the fourth decimal place.

Using this table of discount factors is very simple: if you know the discount rate and the number of periods, for example, 10% and 5 years, then at the intersection of the corresponding columns you will find the coefficient you need.

Example 3. Let's look at a simple example. Let's say you need to choose between two options:

- A) get $100,000 today

- B) or $150,000 in one amount exactly in 5 years

What to choose?

If you know that the bank rate on 5-year deposits is 10%, then you can easily calculate what the amount of $150,000 due in 5 years is equal to today.

The corresponding discount factor in the table is 0.6209 (the cell at the intersection of the 5 years row and the 10% column). 0.6209 means that 62.09 cents received today equals $1 received in 5 years (at 10% interest). Simple proportion:

So $150,000*0.6209 = 93.135.

93,135 is the discounted (present) value of the amount of $150,000 to be received in 5 years.

It's less than $100,000 today. In this case, a bird in the hand is really better than a pie in the sky. If we take $100,000 today and put it on deposit in a bank at 10% per annum, then in 5 years we will receive: 100,000*1.10*1.10*1.10*1.10*1.10 = 100,000*( 1.10) 5 = $161,050. This is a more profitable option.

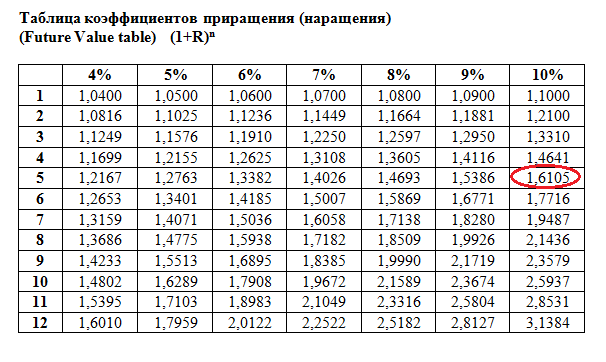

To simplify this calculation (calculating future value given today's value), you can also use a coefficient table. By analogy with the discount table, this table can be called a table of increment (accretion) factors. You can build such a table yourself in Excel if you use the formula to calculate the increment factor: (1+R)n.

From this table it can be seen that $1 today at a rate of 10% will cost $1.6105 in 5 years.

From this table it can be seen that $1 today at a rate of 10% will cost $1.6105 in 5 years.

Using such a table, it will be easy to calculate how much money you need to put in the bank today if you want to receive a certain amount in the future (without replenishing the deposit). A slightly more complicated situation arises when you not only want to deposit money today, but also intend to add a certain amount to your deposit every year. How to calculate this, read the next article. It is called annuity formula.

A philosophical digression for those who have read this far

Discounting is based on the famous postulate "time is money". If you think about it, this illustration has a very deep meaning. Plant an apple tree today and in a few years your apple tree will grow and you will be picking apples for years to come. And if you don’t plant an apple tree today, then in the future you will never try apples.

All we need is to decide: to plant a tree, start our own business, take the path leading to the fulfillment of our dreams. The sooner we take action, the greater the harvest we will get at the end of the journey. We need to turn the time we have in our lives into results.

“The seeds of flowers that will bloom tomorrow are planted today.” That's what the Chinese say.

If you dream about something, don't listen to those who discourage you or question your future success. Don't wait for a lucky coincidence of circumstances, start as early as possible. Turn the time of your life into results.

Large table of discount rates (opens in a new window):

Investing means investing free financial resources today in order to obtain stable cash flows in the future. How not to make a mistake and not only return the invested funds, but also get a profit from the investment?

This article provides not only the formula and definition of IRR, but there are examples of calculations of this indicator (in Excel, graphical) and interpretation of the results obtained. Two examples from life that every person encounters

At its core, the discount rate when analyzing investment projects is the interest rate at which the investor attracts financing. How to calculate it?

The discount rate is an indicator (expressed as a percentage) that reduces all cash flows to their current value.

Where is the discount rate used?

It is known from economic theory that money depreciates over time (affected by inflation). Thus, 100 rubles earned today will be more expensive than 100 rubles earned in 10 years. It will be possible to purchase many more goods or services with them, and by putting them in the bank, after 10 years we will receive additional income in the form of interest payments.

In this regard, a discount rate is used to bring income to the current period of time. This indicator is expressed as a percentage (for example, 10% or 15%, etc.), and when recalculating future payments to the current time, the NPV calculation formula is used:

- CF - the amount of cash flow for a certain period;

- t - time period;

- i is the discount rate.

Moreover, as we see from the formula, it does not matter what kind of cash flow an investment project has, all its cash flows (income, expenses, investments, credits, borrowings, interest on loans and borrowings) are discounted and reduced to the current time.

Example of using a discount rate

Let's say we open a butcher shop, wrote a business plan and received the following cash flows (thousand rubles):

| Article | 0 year | 1 year | 2 year | 3 year | 4 year |

| Investments | - 1 000 | ||||

| Operating income | 2 000 | 2 200 | 2 400 | 2 600 | |

| Operating expenses | 1 600 | 1 750 | 1 900 | 2 050 | |

| Net cash flow | - 1 000 | 400 | 450 | 500 | 550 |

| Cash flow (cumulative) | - 1 000 | - 600 | - 150 | 350 | 900 |

As a result, we see that, according to usual calculations, at the end of the 4th year of the project we will receive a positive cash flow of 900 thousand rubles.

However, to recalculate the current value of money, we need to discount these flows and then we will obtain the net present value of the project. Let's consider two examples of calculations with a discount rate of 10% and 15%.

NPV (i = 10%) = - 1,000 + 400 / (1+0.1) + 450 / (1+0.1) 2 + 500 / (1+0.1) 3 + 550 / (1+0.1) 4 = 486.85 thousand. rub.

NPV (i = 15%) = - 1,000 + 400 / (1+0.15) + 450 / (1+0.15) 2 + 500 / (1+0.15) 3 + 550 / (1+0.15) 4 = 331.31 thousand roubles.

As a result, we get that

- The NPV for the project turns out to be significantly less than the simple cumulative cash flow over the years;

- NPV differs in the first and second calculations, and the higher the discount rate, the lower the net present value.

Therefore, the question arises, how is this discount rate calculated and why should it be exactly this size?

Discount rate calculation

To calculate investment projects, the discount rate most often used is calculated using the weighted average cost of capital (WACC) formula:

, Where

, Where

- WACC - weighted average cost of capital (discount rate);

- E - the amount of equity capital (if the calculation is made for a specific project, then the amount of equity capital planned for investment in the project is considered)

- D - the amount of borrowed capital (if the calculation is made for a project, then the amount of borrowed funds that is planned to be invested in this project is considered)

- V=E+D

- R e - cost of equity capital (takes the alternative risk-free return that the company can get by investing its free cash, usually this is the income on deposits)

- R d - cost of borrowed capital (the interest rate at which the bank or borrower provides funds for investment in the project is taken)

- T c - income tax

As we can see, the discount rate according to the formula for calculating the weighted average cost of capital will very much depend on the current lending and deposit rates that are currently in effect in the country.

An example of calculating the discount rate using WACC as an example

Let's take the following situation as an example:

The company is starting an investment project and for its implementation it is planned that the bank will provide it with a loan in the amount of 1,000,000 rubles. at 15% per annum, and investments of own funds will amount to 500,000 rubles. Moreover, if the company had not started implementing this project, it would have placed its funds on deposit at 9% per annum. At the same time, income tax is 20%.

Substituting all the data from the example into the formula, we get the following result:

WACC = 1,000,000 / 1,500,000 x 15% + 500,000 / 1,500,000 x 9% x (1 - 20%) = 10% + 3% x 0.8 = 12.4%

Other examples of discount rate calculations

If you are interested in how discount rates were calculated for various investment projects, you can view the calculations for various business plans by using the search form or by clicking on the link below.

conclusions

Types of efficiency of investment projects

The following types of efficiency are distinguished:

– effectiveness of the project as a whole:

– effectiveness of participation in the project.

Overall project effectiveness is assessed to determine the potential attractiveness of the project for possible participants and to search for sources of financing. It includes:

– public (socio-economic) efficiency;

– commercial efficiency.

Efficiency of participation in the project is determined in order to verify its financial feasibility and the interest of all its participants in it and includes:

– efficiency for participating enterprises ;

– efficiency for shareholders ;

– efficiency for higher-level structures (national economic and regional, sectoral, budgetary).

Basic principles for assessing the effectiveness of investment projects:

– consideration of the project throughout its entire life cycle (calculation period);

– cash flow modeling;

– comparability of conditions for comparing different projects (project options);

– the principle of positivity and maximum effect;

– taking into account the time factor;

– accounting only for upcoming costs and revenues;

– taking into account the most significant consequences of the project;

– taking into account the interests of different project participants;

– multi-stage assessment;

– taking into account the impact of uncertainty and risks.

Evaluating the effectiveness of investment projects is usually carried out in two stages:

At the first stage performance indicators of the project as a whole are calculated. For local projects, only their commercial effectiveness is assessed and, if it turns out to be acceptable, they move on to the second stage of assessment.

Second phase carried out after determining the financing scheme. At this stage, the composition of participants is clarified and the financial feasibility and effectiveness of participation in the project of each of them is determined.

Features of efficiency assessment at different stages of project development are that:

– at the stages of searching for investment opportunities and preliminary preparation of the project, as a rule, they are limited to assessing the effectiveness of the project as a whole, while cash flow calculations are made in current prices. Initial data are determined on the basis of analogy, expert assessments, and average statistical data. The calculation step is usually taken to last one year;

– at the stage of final preparation of the project, all the above types of efficiency are assessed. In this case, real initial data should be used, including the financing scheme, and calculations should be made in current, forecast and deflated prices.

Purpose of definition financing schemes – provision financial feasibility investment project. Ignoring uncertainty and risk, then a sufficient condition for the financial feasibility of an investment project is the non-negativity at each step of the value of the accumulated balance of the flow.

Economic assessment of investment projects occupies a central place in the process of justification and selection of possible options for investing in real assets. Despite all the other favorable characteristics of the project, it will be rejected if it does not provide:

– reimbursement of invested funds from income from the sale of goods or services;

– obtaining a profit that ensures a return on investment not lower than the level desired for the enterprise;

– return on investment within a period acceptable for the enterprise.

Time value of money

In its most general form, the meaning of the concept “time value of money” can be expressed by the phrase - a ruble today is worth more than the ruble that we will receive in the future. A ruble received today can be immediately invested in business, and it will generate profit. Or you can put it in a bank account and earn interest.

Compound interest formula: ,

where FV is the future value of the amount that we invest in any form today and which we will have over the period of time we are interested in;

PV is the current (modern) value that we invest;

E – the amount of return on investment;

k – the number of time periods during which the investment will participate in commercial circulation.

From the above formula it is clear that to calculate the future value ( F.V. ) compound interest is applied. This means that the interest accrued on the original amount is added to that original amount and interest is also charged on it.

Discounting

To determine the current (modern) value (PV) of future income and expenses, we use the compound interest formula:

.

.

Therefore, the current (modern) value is equal to the future value multiplied by the coefficient  , called the discount factor.

, called the discount factor.

Discounting is the process of bringing (adjusting) the future value of money to its current (modern) value.

Future value of the annuity

Annuity – this is a special case of cash flow, i.e. This is a flow in which cash receipts (or payments) in each period are the same in size.

,

,

where FVA k is the future value of the annuity;

PMT t – payment made at the end of the period;

E – income level;

k is the number of periods during which income is generated.

The current value of the annuity is determined by the formula :

,

,

where PMT t is future cash receipts at the end of the period;

E – rate of return on investments;

k is the number of periods during which future income from modern investments will be received.

Discount coefficient. Discount rate

Discounting cash flows is the reduction of their values at different times to their value at a certain point in time, which is called moment of bringing

and is denoted by  .

.

The moment of reduction may not coincide with the beginning of the time count, t 0 . The discounting procedure is understood in an expanded sense, i.e. as a reduction not only to an earlier point in time, but also to a later one (if  ).

).

The main economic standard used in discounting is the discount rate (E).

Discounting of cash flow at the m-th step is carried out by multiplying its NPV value m (CF m) by the discount factor (), calculated by the formula

,

,

where t m is the moment of the end of the mth calculation step.

Discount rate from an economic point of view –It is the rate of return that an investor would typically receive from an investment of similar content and degree of risk. So this is the expected rate of return.

The following discount rates are distinguished:

– commercial;

– project participant;

– social;

– budget.

Commercial discount rate determined taking into account alternative efficiency of capital use.

Project participant discount rate chosen by the participants themselves.

To assess the commercial effectiveness of the project as a whole, foreign financial management experts recommend using a commercial discount rate set at cost of capital. The total amount of funds that must be paid for the use of financial resources to their owners (dividends, interest) as a percentage of their volume is called cost of capital .

If the investment project is carried out at the expense of the enterprise’s own capital, then the commercial discount rate (for the effectiveness of the project as a whole) can be established in accordance with the requirements for the minimum acceptable future profitability, determined depending on the deposit rates of banks of the first reliability category.

In the economic assessment of investment projects carried out at the expense of borrowed funds, the discount rate is assumed to be equal to the interest rate on the loan.

In the case of mixed capital (equity and debt capital), the discount rate is determined as the weighted average cost of capital:

,

,

where n is the number of types of capital;

E i – discount rate of i-th capital;

d i is the share of the i-th capital in the total capital.

Risk-adjusted discount rate

Depending on the method of taking into account the uncertainty of the conditions for the implementation of an investment project when determining the net present value, the discount rate in efficiency calculations may or may not include a risk adjustment. Risk adjustment is usually made when a project is being evaluated or under a single scenario for its implementation.

The risk adjustment value generally takes into account three types of risks associated with the implementation of an investment project:

country risk;

the risk of unreliability of project participants;

the risk of not receiving the income provided for by the project.

Accounting for changes in the discount rate over time

First of all, this is due to the improvement of the financial markets of Russia, as a result of which the refinancing rate of the Central Bank of Russia is reduced.

The need to take into account changes in the discount rate by steps of the calculation period may also be determined by the method of establishing this rate. Thus, when using a commercial discount rate set at the weighted average cost of capital (WACC), as the capital structure and dividend policy change, the WACC will change.

Discounting cash flows with a discount rate changing over time differs, first of all, in the calculation formula for determining the discount rate:

,

,

where E 0 , ..., E m are the discount rates at the 0th, ..., mth steps, respectively,

0 ,…, m – the duration of these steps in years or fractions.

| " |

Everyone knows about deposits and calculation rules. Bank interest is added to the due amount and we get the amount of funds at the end of the period. For example, $1000 was deposited in the bank. at 20% per annum. Calculation of the total amount at the end of the year: 1000 divided by 100% and multiplied by 120% (100% + 20%). Everything is simple and clear.

However, how can you determine how much you need to invest to get 1000 rubles? in a year. For this, a discount rate is used. The concept is used to assess the profitability of a business and long-term investment.

Concept

“Discount” can be translated as a concession for advance payment. Literally, it means bringing an economic indicator for a certain time period to a given period. In the absence of economic education, it is easy to get confused in such terminology. But a prudent owner should look into the issue, since most people are unaware of their participation in “discounting.” For example, a merchant promises to sell goods at a specified price in a year, when a ship with goods arrives.

However, he needs financial resources to purchase goods that will participate in the exchange transaction. There are two ways to get money: go to a banker for a loan or borrow funds from future buyers. The merchant should explain to the latter about the discount rate in simple language. If clients understand, the success of the event will be ensured.

The discount rate is used for the following purposes:

- Calculation of business profitability. An investor must know the amount of profit in the future in order to invest funds with the desired return.

- Evaluation of the organization's activities. Existing profits do not guarantee good profitability.

- Profitability planning. The investment option chosen should have the maximum return compared to alternative options. For example, one business will have a certain profit after 1 year, while another will bring in more money, but only after two years. Both proposals should be compared on the same denominator. For clarity, let's look at a practical example. Two businessmen approached a potential investor. They ask to invest 2 million in their business. The first one promises to return 3 million in two years, the second - 5 million in 6 years. How to calculate the discount rate when attracting borrowed capital?

Discounting in everyday life

Every Russian has thought at least once about the “value of money.” It is especially noticeable when shopping in supermarkets, when you have to remove “unnecessary” goods from the grocery basket. Nowadays it is necessary to be economical and prudent. Discounting is often understood as an economic indicator that shows the purchasing power of money and its value over a certain period of time. Discounting is used to predict profits for investment projects. Future results can be estimated at the beginning of the project or during its implementation when multiplied by the discount factor. But this concept applies not only to investments, but also in everyday life. For example, parents want to pay for their child’s education at a prestigious institution. But not everyone has the opportunity to pay the fee at the time of admission. Then they begin to think about the “stash”, which is intended for hour X. In 5 years, the child is planned to enter a European university. The cost of preparatory courses is 2500 USD. For many, it is unrealistic to allocate a similar amount from the family budget without harming the interests of other members. The solution is to open a deposit in a financial institution in advance. But how to determine the deposit amount in order to receive 2500 USD in five years? The deposit rate is 10%. Calculation of the initial amount: 2500/(1+0.1)^5 = 1552 USD This is called discounting.

In simple words, if you want to know the future value of a certain amount, you should “discount” it at a bank rate, which is called the discount rate. In the example given, it is equal to 10%, 2500 USD. - cash flow (payment amount) in 5 years, 1552 USD - discounted value of cash flow.

Discounting will be the opposite of the investment. For example, when investing 100 thousand rubles at 10% per annum, the result is 110 thousand rubles: 100,000* (100% + 10%)/100%.

A simplified calculation of the final amount will help determine the profitability of the investment. However, it is subject to adjustments.

When determining income for a couple of years, they resort to exponentiation. A common mistake is to multiply by the total interest amount to account for "interest on interest." Such calculations are acceptable in the absence of interest capitalization.

To determine the discount rate, you need to find the initial investment amount: multiply the final profit by 100%, and then divide by the amount of 100% increased by the rate. If investments go through several cycles, then the resulting figure is multiplied by their number.

In the international format, the English-language terms Future value and present value are used. In the described example, FV is 2500 USD, PV is 1552 USD. General form of discounting:

PV = FV*1/(1+R)^n

1/(1+R)^n- discount factor;

R- interest rate;

n- the number of cycles.

The calculations are quite simple; not only bankers can perform them. But the calculations can be ignored if you understand the essence of the process.

Discounting- change in cash flow from the future to the present, i.e. The path of finance goes from the amount that is required to be received at a certain moment to the amount that will be invested.

Money + time

Let's consider another common situation: there are free funds that you decide to deposit in the bank at interest. Amount - 2000 USD, interest rate - 10%. In a year, the depositor will already have 2200 USD at his disposal, since the interest on the deposit will be 200 USD.

If we bring all this to a general formula, we get:

2000*(100%+10%)/100% = 2000*1.1 = 2200 USD

If you put 2000 USD for 2 years, then the total amount will be 2420 USD:

1 year 2000*1.1 = 2200 USD

Year 2 2200*1.1 = 2420 USD

There is an increase without additional contributions. If the investment period is extended, the income will increase even more. For each move of keeping funds on deposit, the total amount of the deposit for the previous year is multiplied by (1+R) or the initial amount of investment is multiplied by (1+R)^n.

Cumulative method

To simplify the calculations, use a table of coefficients. When using it, you no longer need to calculate the investment amount and profitability using the formula several times. It is enough to multiply the final profit by the coefficient from the table to get the desired investment.

Formula for determining the discount factor:

K = 1/(1+Pr)^B,

Where IN- the number of cycles;

Etc- interest rate per cycle.

For example, for a two-year investment at 20%, the coefficient is:

1*/(1+0,2)^2 = 0,694

Discounting tables are similar to Bradis tables, which help students identify roots, cosines, and sines.

Discount factor tables make calculations easier. However, this calculation method is not suitable for large investments. The given values are rounded to thousandths (3 decimal places), which leads to a large error when investing in millions.

Using the table is simple: if the rate and the number of periods are known, the required coefficient is found at the intersection of the required columns and rows.

Practical use

When the discount rate increases, the payback period for investments increases. The decision to invest funds should be made when calculations show the desired payback period and correspond to the capital investment plan.

A simplified calculation is made using the return on investment period formula. It is based on the quotient between funds received and invested. The main disadvantage of this method is that the assumption of uniform income is applied.

The given formulas do not take into account market risks. They can only be used for theoretical calculations. To bring the calculation closer to reality, they resort to graphical analysis. The graphs present data on the movement of finances in a certain time interval.

Discounting and escalation

Using a simple formula, the size of the contribution is determined at the desired time point. Calculating the future value of money is called “accretion.” The essence of this process is easy to understand from the expression “time is money” - over time, the size of the deposit increases by the size of the increment with annual interest. The entire banking system is based on this principle.

When discounting, the movement of calculations goes from the future to the present, and when “building up” - from the present to the future.

Discounting and building up help analyze the possibility of changes in the value of funds.

Investment projects

Discounting of funds corresponds to the investment motives of the business. That is, the investor invests money and receives not human (qualified specialists, team) or technical resources (equipment, warehouses), but a flow of money in the future. A continuation of this thought would be “the product of any business is money.” The discounting method is the only one that exists, the orientation of which is aimed at development in the future, which allows the investment project to develop.

An example of choosing an investment project. The owner of funds (600 rubles) was asked to invest them in the implementation of projects “A” and “B”. The first option gives an income of 400 rubles for three years. Project “B” after the first two years of implementation will allow you to receive 200 rubles, and after the third - 10,000 rubles. The investor determined the rate to be 25%. Let's determine the current cost of both projects:

project “A” (400/(1+0.25)^1+400/(1+0.25)^2+400/(1+0.25)^3)-600 = (320+256+204 )-600 = 180 rubles

project “B” (200/(1+0.25)^1+200/(1+0.25)^2+1000/(1+0.25)^3)-600 = (160+128+512 )-600 = 200 rubles

Thus, the investor must choose the second project. However, if the rate increases to 31%, both options will be equivalent.

Present value

Present value is the present value of a future cash flow or future payment without the prepayment “discount.” It is often called present value - future cash flow relative to today. However, these are not exactly the same concepts. It is possible to bring not only one future value to the current time, but also the present value to the desired time in the future. Present value is more extensive than discounted value. In English there is no concept of present value.

Discounting method

It was mentioned earlier that discounting is a tool for predicting future profits - assessing the effectiveness of a current project.

When evaluating a business, they take into account that part of the assets that are capable of generating income in the future. Business owners take into account the time it takes to generate income and the likely risks to making a profit. The listed factors are taken into account when assessing using the DCF method. It is based on the principle of “falling” value - the money supply constantly “gets cheaper” and loses value. The starting point will be the present value against which future cash flows are related. For this purpose, the concept of discount factor (K) was introduced, which helps to bring future flows to current ones. The main component of the DCF method is the discount rate. It determines the rate of return when investing in a business project. The discount rate can take into account various factors: inflation, refinancing rate, valuation of capital shares, interest on deposits, return on risk-free assets.

It is believed that an investor should not finance a project if its cost becomes higher than the present value of future earnings. Likewise, a business owner will not sell his assets for less than the price of future earnings. During negotiations, the two parties will come to a compromise in the form of the equivalent value on the day of the transaction of the projected assets.

An ideal investment option if the discount rate (internal rate of return) is greater than the cost of finding financing for the business idea. This will allow you to earn like banks - money will be accumulated at a reduced rate, and the deposit will be made at a higher rate.

Additional calculations

Determining the discount rate is inaccurate without analyzing some terms and concepts:

- The rate of return is the amount of investment at which the amount of net present income will be 0.

- Net cash flow - costs are subtracted from total gross receipts. Direct and indirect expenses (tax deductions, legal support) should be included here.

Only an expert can determine the exact value of a company’s profitability, based on the company’s internal analysis.

Advanced calculations

In economics, a somewhat complicated calculation is used, which takes into account a number of risks. The formulas use the following concepts:

- Risk-free, expected and market returns. Used in the Sharpe formula to determine economic risks.

- Adjusted Sharpe model. Determines the influence of market factors: changes in the cost of resources, government policy, price fluctuations.

- Amount of capital investment, features of the industry. The data is used in a more accurate version of French and Fama.

- Changes in the value of an asset are used in the Carhart formula.

- Dividend payments and issue of shares. Similar calculations are due to Gordon. His method allows you to accurately study the stock market and analyze the value of joint stock companies.

- Weighted average price. Apply before determining the discount rate in the cumulative method and accounting for borrowed funds.

- Profitability of property. They are used to analyze the financial activities of a company whose assets are not listed on the stock market.

- Subjective factor. Used in multifactor analysis of an organization’s activities by third-party experts.

- Market risks. Take into account when determining the discount rate based on the ratio of risky to risk-free investment.

In 1997, the Russian government published its own methodology for calculating the risk discount rate. Experts at the time estimated the risks at 47%. This indicator is not used in conventional formulas, but it is mandatory when calculating investments in foreign projects.

Various calculation methods allow you to evaluate potential investments and build a plan for the allocation of financial resources. When analyzing the economic activities of companies on the market, theoretical calculations will give the expected effect if local realities are taken into account. Simple calculations will help predict profitability, but it will be highly subject to fluctuations. For forecasting, you need to use complex formulas that take into account most risks in the financial and stock markets. More accurate data will be obtained only through internal analysis of the company.

The discount rate is the rate of return. The indicator influences both the decision to invest funds and the assessment of a company or a separate type of business. We will calculate the discount rate using several methods and give recommendations to avoid errors in calculations.

What is a discount rate in simple words

Discounting is the determination of the value of cash flows relating to future periods (future income to date). To correctly assess future income, you need to know the projected values of revenue, expenses, investments, , the residual value of the property, as well as the discount rate, which is used to evaluate the effectiveness of investments.

From an economic point of view is the rate of return on invested capital required by the investor. In other words, it can be used to determine the amount that an investor will have to pay today for the right to receive expected income in the future. Therefore, key decisions, including when choosing an investment project, depend on the value of the indicator.

Example

When implementing project “A”, the investor receives an income of 500 rubles at the end of the year for three years. When implementing project “B”, the investor receives income at the end of the first and at the end of the second year of 300 rubles, and at the end of the third year - 1100 rubles. The investor needs to choose one of these projects.Let's assume that the investor has set the rate at 25% per annum. The present value (NPV) of projects “A” and “B” is calculated as follows:

where P k - cash flows for the period from 1st to nth years;

r - discount rate - 25%;

I - initial investment - 500.

NPV A = – 500 = 476 rub.;

NPV B = – 500 = 495.2 rub.

Thus, the investor will choose project “B”. However, if he sets a discounted rate, for example, equal to 35% per annum, then the current costs of projects “A” and “B” will be equal to 347.9 and 333.9 rubles. accordingly (the calculation is similar to the previous one). In this case, project “A” is more preferable for the investor.

Consequently, the investor’s decision completely depends on the value of the indicator; if it is more than 30.28% (with this value of NPV A = NPV B), then project “A” is preferable; if it is less, then project “B” will be more profitable.

VIDEO: How to calculate NPV in Excel

There are various methods for calculating the discount rate. Let's consider the main ones in descending order of objectivity.

Calculation of the discount rate using the CAPM method

To calculate the discount rate, the Capital Assets Pricing Model (CAPM), which is based on an assessment of the company's capital, works most effectively and accurately in practice. We tell you more about how to use the CAPM method for calculations in the material of the Financial Director magazine.

Determination of the weighted average cost of capital

Most often, in investment calculations, the discount rate is determined as weighted average cost of capital (weighted average cost of capital - WACC), which takes into account the cost and the cost of borrowed funds. This is the most objective calculation method. Its only drawback is that in practice not all enterprises can use it (this will be discussed below).

Calculation of the cost of equity capital

For determining cost of equity a long-term asset valuation model is used ( capital assets pricing model - CAPM).

The discount rate (return) on equity capital (Re) is calculated using the formula:

R e = R f + B(R m - R f),

where R f is the risk-free rate of return;

B is a coefficient that determines the change in the price of a company’s shares compared to the change in share prices for all companies in a given market segment;

(R m – R f) - premium for market risk;

R m - average market rates of return on the stock market.

Let us consider in detail each of the elements of the long-term asset valuation model.

The rate of return on investments in risk-free assets (R f). Government securities are usually considered risk-free assets. In Russia, these are Russian Eurobonds Russia-30 with a maturity of 30 years.

Factor B. This coefficient reflects the sensitivity of the return on securities of a particular company to changes in market (systematic) risk. If B = 1, then the fluctuations in the price of shares of this company completely coincide with the fluctuations of the market as a whole. If B = 1.2, then we can expect that in the event of a general rise in the market, the value of the shares of this company will rise 20% faster than the market as a whole. Conversely, in the event of a general decline, the value of its shares will decline 20% faster than the market as a whole.

In Russia, information on the values of B-ratios of companies whose shares are the most liquid can be found in information releases of the AK&M rating agency, as well as on its website in the “Ratings” section. In addition, B-ratios are calculated by analytical services of investment companies and large consulting firms, for example Deloitte & Touche CIS.

Market risk premium (R m - R f). This is the amount by which average market rates of return in the stock market exceeded the rate of return on risk-free securities over an extended period of time. It is calculated based on statistical data on market premiums over a long period. According to Ibbotson Associates, the long-term expected market premium, based on the difference between average stock market returns and risk-free investment returns in the United States from 1926 to 2000, is 7.76%. This value can also be used for calculations by Russian companies (in a number of textbooks, the premium for market risk is taken to be 5%).

WACC calculation

If not only own but also borrowed capital is attracted to finance a project, then the profitability of such a project should compensate not only the risks associated with investing own funds, but also the costs of attracting borrowed capital. The weighted average cost of capital (WACC) indicator allows you to take into account the cost of both equity and borrowed funds, which is calculated using the formula:

WACC= R e (E/V) + R d (D/V)(1 – t c),

where R e is the rate of return on equity capital, calculated, as a rule, using the CAPM model;

E is the market value of equity (shareholder) capital. It is calculated as the product of the total number of ordinary shares of the company and the price of one share;

D is the market value of borrowed capital. In practice, it is often determined from financial statements as the amount of company borrowings. If this data cannot be obtained, then available information on the ratio of equity and debt capital of similar companies is used;

V = E + D - the total market value of the company's loans and its share capital;

R d is the rate of return on the company's borrowed capital (the cost of raising borrowed capital). Such costs include interest on bank loans and corporate bonds of the company. In this case, the cost of borrowed capital is adjusted taking into account the income tax rate. The meaning of the adjustment is that interest on servicing loans and borrowings is included in the cost of production, thereby reducing the tax base for income tax;

t c is the income tax rate.

Example

Let's calculate the rate using the weighted average cost of capital (WACC) model for the Norilsk Nickel company, taking into account the current conditions prevailing in the Russian economy.

For calculations we will use the following data as of mid-February:

Rf = 8.5% (rate on Russian European bonds);

B = 0.92 (for the Norilsk Nickel company, according to the AK&M rating agency);

(Rm - Rf) = 7.76% (according to Ibbotson Associates).

Thus, the return on equity is:

Re = 8.5% + 0.92 × 7.76% = 15.64%.

E/V = 81% - the share of the market value of share capital (E) in the total value of capital (V) of the Norilsk Nickel company (according to the author).

Rd = 11% - weighted average costs of raising borrowed capital for the Norilsk Nickel company (according to the author).

D/V = 19% - the share of the company's debt capital (D) in the total cost of capital (V).

tc = 24% - income tax rate.

So WACC = 81% × 15.64% + 19% × 11% × (1 – 0.24) = 14.26%.

As we have already noted, not all enterprises can use the approach described above. Firstly, it does not apply to companies that are not public joint stock companies, therefore, their shares are not traded on stock markets. Secondly, this method will not be able to be applied by firms that do not have sufficient statistics to calculate their B-coefficient, as well as those who do not have the opportunity to find a similar enterprise whose B-coefficient they could use in their own calculations. Such companies should use other calculation methods to determine the discount rate.

Risk premium estimation method

One of the most common methods for determining the discount rate in practice is the cumulative method of estimating the risk premium. This method is based on the assumptions that:

- if investments were risk-free, then investors would demand a risk-free return on their capital (that is, a rate of return corresponding to the rate of return on investments in risk-free assets);

- The higher the investor assesses the risk of a project, the higher the requirements he places on its profitability.

Based on these assumptions, the calculation must take into account the so-called “risk premium”. Accordingly, the formula will look like this:

R = Rf + R1 + ... + Rn

where R is the discount rate;

Rf - risk-free rate of return;

R1 + ... + Rn - risk premiums for various risk factors.

The presence of one or another risk factor and the value of each risk premium in practice are determined by experts.

Determining the discount rate by expert means

The simplest way to determine the discount rate, which is used in practice, is to determine it by expert means or based on the requirements of the investor. The approximate amount of adjustments for the risk of not receiving the income envisaged by the project is presented in Table 1.

Table 1. Adjustments for the risk of non-receipt of project income

However, it must be taken into account that the expert method will give the least accurate results and may lead to distortion of the project assessment results. Therefore, when determining an indicator by expert or cumulative method, it is necessary to analyze the sensitivity of the project to changes in the discount rate. Then the investor will be able to more accurately assess risks and its effectiveness.

Example

Let's look at the conditional projects “A” and “B” from the first example. The results of the analysis of their sensitivity to changes in the discount rate are presented in table. 2.

table 2. Project sensitivity analysis

There are other alternative approaches to calculation, such as using the theory of arbitrage pricing or the dividend growth model. However, these theories are quite complex and are rarely used in practice, so they are not discussed in this article.

Practical application issues

When calculating, we must remember to take into account a number of important points. Otherwise, there is a danger of making mistakes.

Inconstancy of capital structure. During the settlement period of the project, the structure may change (for example, as the loan is repaid, the debt decreases and at some point will become zero). Hence the question: how to calculate the discount rate in such a situation?

To determine a single discount rate for the entire period of project implementation, I propose to use the optimal capital structure. That is, the optimal ratio of equity and borrowed funds, at which the cost of capital (WACC) is minimal. But it is important not to forget that in practice the cost of equity capital is higher than debt capital, therefore, as the share of borrowed funds increases, the WACC decreases. However, as debt obligations increase, the risk of bankruptcy increases and, accordingly, debt servicing costs increase and the cost of borrowed capital increases. Accordingly, when a certain level of the debt-to-equity ratio is reached, the WACC begins to increase.

Income tax volatility. When determining the cost of capital taking into account the tax shield, you are sometimes faced with the problem of choosing an estimated income tax rate. If during the settlement period the company operates within one of the standard tax regimes, then no questions arise - the tax rate established by law is chosen. However, there are cases when the income tax rate is not constant. For example, when a project is taxed at a preferential rate for a certain period of time (most often during the period of repayment of borrowed funds or during the first years of implementation). In this situation, two calculation options can be distinguished.

1. If one rate (for example, preferential) is valid at the beginning of the project and then for a significant part of the time of its implementation (more than half), then you can take it for calculation.

2. If the rate changes periodically and does not remain at the same level for a long time within the billing period, then it is necessary to calculate its weighted average value using the formula:

t - project implementation period;

T1, T2, …, TN - current income tax rates for periods of time.

If an enterprise has several separate divisions that are subject to the tax laws of different countries, then the rate should be calculated as a weighted average based on several rates and volumes of the tax base.

where T is the weighted average income tax rate;

p is the total profit of the enterprise (it is recommended to take profit values for the entire sales period);

T1, T2, …, TN - current income tax rates in the territories of various countries;

p1, p2, …, pN - profit in different countries (for calculation it is recommended to take data for the entire sales period).

Accounting for inflation. If the project is calculated in inflation-adjusted prices, then inflation is added to the nominal discount rate. It can be taken into account in two ways. First: when the rate is calculated for each discounting step separately, the forecast value of inflation for this time period is added. Second: in the case of calculating a single rate for the entire calculation period of the project, the average value of the forecast inflation indicator for the project calculation period is added.

To summarize, we note that most enterprises in the process of work are faced with the need to determine the discount rate. Therefore, it should be remembered that the most accurate value of this indicator can be obtained using the WACC method, while other methods give a significant error.