Average headcount by individual entrepreneur. When will the average value of an individual entrepreneur without employees be zero? What does the average number of individual entrepreneurs without employees consist of?

Information on the average number of employees (AMN) - This is one of the first reports of the newly created LLC. The reporting form looks simple, however, submitting the SSR raises a lot of questions, which we will answer in this article.

Who must submit information about the number of employees

Judging by the name, only employers must submit information about the average number of employees. But the Ministry of Finance believes that all companies must report, including newly organized ones that do not yet have employees. From the letter of the Ministry of Finance of the Russian Federation dated February 4, 2014 No. 03-02-07/1/4390: “... there is no provision for the exemption of organizations that do not have employees from representation in tax authorities within the prescribed period of information on the average number of employees.”

Let's list who is required to submit a report on the average headcount:

- just registered legal entities, regardless of staff availability;

- individual entrepreneurs-employers;

- organizations that have concluded ;

- organizations that do not have employees on staff.

Thus, only individual entrepreneurs without employees have the right not to submit this information; all other businessmen are required to report.

Who to include in the headcount for the report

The calculation of the average headcount in 2018 is carried out in accordance with the Instructions approved by Rosstat Order No. 772 dated November 22, 2017. The Instructions list the categories of workers who are included in the number for the report, and those who are not taken into account in the calculation.

A lot of controversy arises over the inclusion in the SCR of information about the only founder, who does not receive a salary. Should he be taken into account in the number of employees, since he performs administrative functions for the management of the LLC? No, it’s not necessary, there is a clear answer to this question in paragraph 78 (g) of the Directives.

Average headcount is calculated only in relation to personnel hired by employment contract. This is the main difference between this indicator and reports to funds, which also take into account employees registered under a civil law contract. In this case, the duration of work under the employment contract does not matter; everyone who performs permanent, temporary or seasonal work is included in the information of the SCH. Separately, those who are employed full-time and those who work part-time are taken into account.

IN general case The average payroll number is determined by adding the number of employees on the payroll for each month of the reporting year and dividing the resulting amount by 12. The final result is indicated in whole units, because it means the number of working people in the state.

Deadline for delivery of the SSR in 2018

The deadline for submitting information on the average number of employees is established by Article 80 of the Tax Code of the Russian Federation. According to her, you need to submit this form no later than January 20 current year for the previous calendar year. But the deadline for submitting a report on the average number of new organizations (legal entities that have just been created or reorganized) is no later than the 20th of the month, following the one in which the organization was registered or reorganized.

For example, the creation of an LLC occurred on January 10, 2018, therefore, information on the average headcount of the newly created organization must be submitted no later than February 20, 2018. Next, the company reports in the general manner, i.e. For 2018, the report on the number of employees must be submitted by January 20, 2019 inclusive.

If the delivery deadline is violated, the LLC will be fined under Article 126 of the Tax Code of the Russian Federation in the amount of 200 rubles. In addition, an administrative punishment of an official (chief accountant or director) in the amount of 300 to 500 rubles is possible under Article 15.6 of the Code of Administrative Offenses of the Russian Federation.

Important: information on the average number of employees new organization Although they are submitted to the Federal Tax Service, they are not a tax return, so tax authorities do not have the right to block the LLC’s current account due to late submission deadlines.

Report form

The SChR report is submitted on a form approved by order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/174@. Recommendations for filling out the form are given in the letter of the Federal Tax Service of Russia dated April 26, 2007 No. CHD 6-25/353@.

The report on the average headcount for newly created organizations consists of one sheet and has a fairly simple appearance.

In the top lines of the form (the fields to fill out are highlighted in color) indicate the TIN and KPP of the legal entity. The name of the Federal Tax Service is entered in full, indicating the number and code of the tax authority. The name of the company is given in full, for example, not “Alfa LLC”, but “Society with limited liability"Alpha".

The only significant indicator of the SCHR report is the average headcount, calculated in accordance with Instructions No. 772. If information is submitted for the past calendar year, then January 1 of the current year is indicated in the date fields. The information is signed by the head of the legal entity, but this can also be done by confidant. When submitting a report by proxy, you must enter the details of this document and attach a copy.

The report on the average headcount for newly created organizations differs from the usual annual report only in the date. Please note the footnote marked with (*) - the number of personnel is indicated not as of January 1 of the current year, but as of the 1st of the month following the month in which the LLC was registered. For example, if a company was registered on January 10, 2018, then the number of staff is indicated as of February 1, 2018.

We provide a sample of filling out a report on the average number of employees of a newly created LLC, in which the employment contract is concluded only with the general director.

.png)

Submission methods

The number of employees under an employment contract is important not only when calculating taxes, but also when choosing the method of submitting the CHR report: paper or electronic. Typically, information about the average headcount of a newly created organization is submitted to in paper form, because the number of employees hired in the first month rarely exceeds 100 people.

The rule of Article 80 (3) of the Tax Code of the Russian Federation states that only taxpayers with no more than 100 people have the right to submit tax returns and calculations in paper form. If we take it literally, then this article should not apply to the report on the average headcount, because it is not taxable. However, tax officials insist that if the number of employees exceeds 100 people, information about their number should also be submitted in electronic format.

In fact, this requirement does not cause any particular difficulties, given that since 2015, insurance premium payers are required to submit reports on insurance premiums to electronic form, already starting from 25 people. That is, if the number of employees in your company exceeds 25 people, you will still have to issue an electronic digital signature, which can be used to sign all reports.

A report on the number of employees is submitted to the tax office at the place of registration: according to the registration of an individual entrepreneur or legal address OOO. If the document is issued on on paper, then you can submit the report in person to the Federal Tax Service or by mail with a list of attachments.

Small and large enterprises are required to send information about average number of employees. Is it necessary to submit an individual entrepreneur without employees? such a report? What deadlines are provided by tax legislation? The answers are in our consultation.

The role of information

The average headcount report is a document that includes an indicator of the average number of employees working for a merchant during the year. The purposes of its submission to the Federal Tax Service are as follows:

- The ability to control the legality of the status of an economic entity. For example, average headcount for individual entrepreneurs who own small firms cannot exceed 15 people.

- Establish a method for presenting certain reports. For example, small organizations are allowed to submit 6-NDFL in paper or in electronic format, and large ones - only in electronic form.

- Easier for tax authorities to control insurance premiums to funds.

Submission deadlines

Information on the average number of employees must be submitted to the tax office no later than January 20, 2018(inclusive). This is what it says in paragraph 3 of Art. 80 Tax Code of the Russian Federation. This report will be for 2017, since the document is submitted once a year.

All organizations are required to comply with the deadline requirement - LLC, CJSC, PJSC, etc.). Moreover, regardless of the presence or absence of workers.

If the registration procedure for a legal entity has been completed quite recently, then the report is sent before the 20th day of the month, which comes after the month of opening.

As for businessmen, information about average number of individual entrepreneur employees are served provided that:

- are registered as an employer;

- use hired labor.

They are subject to a similar deadline requirement (except for the rule of the next month after creation/reorganization).

The individual entrepreneur’s report in question is submitted to the Federal Tax Service at the place of residence.

Count: Is individual entrepreneur included in the average headcount?

As a rule, the report is compiled on the basis of a time sheet: the number of employees present for each working day is summed up and the result is divided by the number calendar days month. Then the data for each month is divided by 12.

Note:

- Only personnel under an employment contract need to be taken into account;

- The individual entrepreneur himself does not need to be included in the average headcount.

When drawing up a report on the average number of employees, individual entrepreneurs do not take into account personnel who:

- leads labor activity outside the Russian Federation;

- transferred to another organization;

- works under a student contract;

- are on maternity leave, etc.

When there is no staff: Do individual entrepreneurs pass the average?

Often, businessmen independently conduct their business affairs, without hiring people or attracting family members (friends) without concluding an employment contract. In this case, you do not need to submit the report in question. A similar rule applies when concluding contracts only of a civil nature.

Exemption from taking the average salary for individual entrepreneurs without employees is possible on the basis of clause 3 of Art. 80 Tax Code of the Russian Federation. This norm establishes the circle of persons who are required to submit a report to the Federal Tax Service on the average number of personnel per year: legal entities and individual entrepreneurs using hired labor.

Thus, only merchants who entered into an employment contract face a fine for failure to submit a report or violation of a deadline. Individual entrepreneurs without employees do not submit the average number of employees for 2017. Therefore, if you receive a notification with such a requirement, you need to inform the tax authorities about the error.

The average number of employees of the Limited Liability Company is special kind reporting provided for by order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/. The wording “Average headcount without employees of an LLC” implies that these reports are submitted by a company that has no employees. Could this be possible? Yes, this is possible, because this is one of the first reports that even new companies and companies without employees, which can only have a founding director, are required to fill out. The form looks simple enough to fill out, but questions regularly arise: “How to fill out the average headcount of an LLC without employees” and the like.

Who should take it?

From the name of this reporting document one can judge that only employers submit it, but this is not the case, as law enforcement agencies confirmed. The Ministry of Finance in a letter dated 2012 (Letter of the Ministry of Finance of Russia dated July 17, 2012 N 03-02-07/1-178) explains that, despite the lack of personnel, it is necessary to hand over the average number of LLCs without employees. This obligation also extends to newly created societies that have not yet even managed to form a staff and have not recruited any workers. The sample average headcount when opening an LLC looks slightly different than for operating companies, and is filled out according to certain rules, which will be discussed below.

Who is required to submit:

- newly registered and organized Societies, regardless of whether there are personnel;

- Individual entrepreneurs who are employers;

- organizations that have employees on staff with whom employment contracts have been concluded;

- organizations that do not currently have employees on staff.

That is, only individual entrepreneurs who are not employers can not take the SSC.

How the average number of employees is calculated, a sample of filling out the form for an LLC is further in the article.

Who to include in the report

Instructions for filling out the form are given in Rosstat Order No. 772 dated November 22, 2017. Only those employees with whom an employment contract has been concluded are taken into account. It doesn’t matter what kind of work is performed: seasonal, temporary, the main thing is that the specialist works for more than one day in the company. That's why sole founder, if an employment contract has not been concluded with him and wages he does not receive it and is not reflected in this form (clause 78 of the Instructions).

How to calculate and fill out the form

The calculation formula is simple: you need to add up the payroll number of workers (determined on the basis of orders for hiring and dismissal, time sheets) for all 12 months and divide the resulting amount by 12. It is also necessary to take into account the fact that if the employee worked part-time or a week - you will have to take it into account not as a unit, but in proportion to the time worked. However, in the end, the final result is entered in the form in whole values. This is a general formula; there are many details of the calculation. For newly formed societies, it is important to take into account that despite the fact that it may have worked for less than a full year, the denominator “12” is still used in the formula.

If employees were hired

In this case, you must correctly fill out the form “Average number of employees when opening an LLC” and submit the report by the 20th day of the month following the month in which the Company was created. If employees have been hired, the indicator is calculated per month, this is directly stated in the instructions. For getting correct result it is necessary to divide the payroll for the period of activity of the organization into total calendar days in the past month.In the absence of employees

How is the average headcount calculated if there are no employees (LLC established in 2019)? Such a company, of course, may not have employees. However, it must submit reports by the 20th day of the month following its creation. In such cases, a responsible founder who does not want to start activities with violations may have questions: What is the average number of employees of an LLC without employees? What to include in the report? Answer: if there were no workers at all, then the value is simply set to zero; there is no information or data for the calculation.

The average number of employees in the absence of LLC employees at the time of submission of the form is determined by general formula(number of employees/12). And if the numerator of the formula is 0, which means: there are no and there were no workers, a zero is entered in the form. But this does not exempt you from submitting the form, otherwise you may face a fine.

Due dates

The average number of LLCs without employees in 2019 raises questions regarding the deadline, let us explain once again general rules. The general deadline is until January 20 of the year, for new companies - until the 20th day of the month following the month the company was founded.

Since January 20, 2019 falls on a Sunday, the deadline for submitting the report is postponed to January 21, Monday.

Where and how to send the report

Information on the average number of LLCs without employees is provided to the Federal Inspectorate tax service at the place of registration in mandatory according to the above rules.

The average number of employees during the liquidation of an LLC is also submitted on the date of liquidation; this obligation is established, but if this rule is not followed negative consequences for the liquidator, this most often does not happen in practice.

How to submit the average number of employees for an LLC without employees? The same methods work as for other societies:

- on paper (in person, or through a representative, or by mail);

- electronically.

When submitting the form to the Federal Tax Service, the employee may not accept the form if it is filled out incorrectly. But usually minor errors can be corrected directly during submission, the main thing is to calculate the numbers correctly. In this case, you need to pay attention to all the details; the instructions contain quite a lot of calculation instructions regarding different categories workers: part-time workers, part-time workers, etc. Having filled out this form once, there will be much fewer questions in the future; the form itself takes only one sheet.

Responsibility

Violation of the deadlines for submitting the report is punishable by a fine of 200 rubles. A separate fine can be issued to the manager - in the amount of 300 to 500 rubles.

A report on the average headcount for an individual entrepreneur is a form that an individual entrepreneur must fill out and submit to the Tax Inspectorate in two cases: either at the end of the year (before January 20), or in the next month after registration (also before the 20th). But does an individual entrepreneur without employees rent out the average number of employees? This question worries many entrepreneurs, because legislation is constantly changing and being clarified.

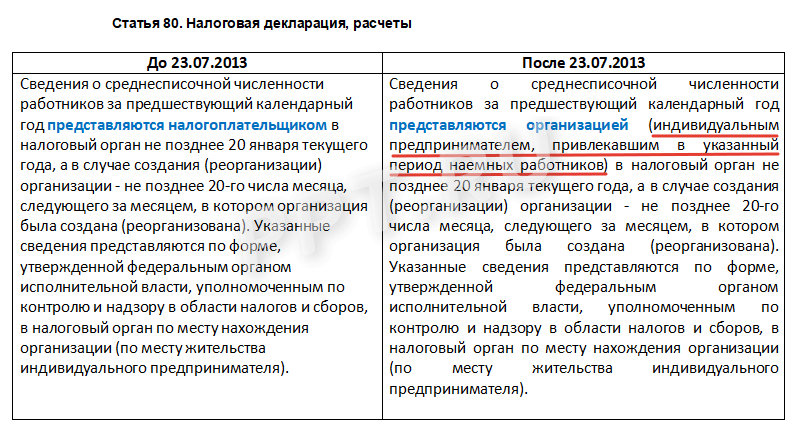

The report on the average number of employees for individual entrepreneurs is a report to the Inspectorate of the Federal Tax Service. The average number of individual entrepreneurs without employees (2019) sounds like an obvious oxymoron: no employees, no report. However, in the past this was not so obvious, so individual entrepreneurs still have questions regarding this type of reporting documentation. Previously, it was mandatory for all taxpayers. But then, back in 2013, in paragraph 3 Art. 80 of the Tax Code of the Russian Federation changes have been made.

Is it necessary to submit the average number of individual entrepreneurs without employees in connection with the above changes? The answer is later in the article, but first let’s define the goals of this report and general order filling it out.

Purposes of reporting and persons required to submit the form

A report on the average headcount (or, otherwise, SSC) is a small report that provides information on the number of workers in an enterprise: those employed by an individual entrepreneur or in an organization. The report form was approved by Order of the Federal Tax Service of the Russian Federation dated March 29, 2007 N MM-3-25/ and looks like this:

Information on the average number of individual entrepreneurs without personnel was always submitted using the same form. The form looks very simple, but you need to know the specifics of counting the number of workers. It is contained in the Instructions set out in the Letter of the Federal Tax Service of the Russian Federation dated April 26, 2007 N CHD-6-25/ The report on the average number of individual entrepreneurs without employees was also traditionally filled out according to these rules.

Objectives of this reporting:

- control over the number of full-time employees in order to correct definition status of the person (small, large enterprise, etc.);

- clarification of the method of submitting and compiling reports (some entities can now submit them only electronically);

- simplification of control over the payment of insurance premiums.

So, the SSC report allows tax authorities to monitor certain aspects of the enterprise’s activities.

Features of SSC for individual entrepreneurs

Why do individual entrepreneurs without employees rent out the average number? This question has arisen for many people in practice. In addition to them, legal entities without employees, and even newly organized LLCs had to submit this report. The fact is that the legislator proceeded from the position that if in currently and there are no employees on staff; during the reporting period (a year in this case) they could be hired and fired.

However, the Tax Inspectorate is no longer interested in such information about individual entrepreneurs: the average number of employees without employees (2019) - obviously equal to zero- is no longer a reason to prepare and submit a report. And this happened in 2013 - it was then in Tax Code of the Russian Federation changes have been made. According to them, now individual entrepreneurs who do not have hired labor do not submit such reports.

The table below shows the changes made to the Tax Code, thanks to which the need to submit the SSC for individual entrepreneurs who did not have employees in the reporting year has disappeared.

Why does an individual entrepreneur not need to include himself in the form?

Despite the fact that changes to the Tax Code were made more than five years ago, individual entrepreneurs do not stop worrying and asking how to fill out the SSC for individual entrepreneurs without employees. Doesn't an individual entrepreneur still need to make such a report, including himself in it? Let's figure out why individual entrepreneur shouldn't do this. The answer is based on the interpretation of the law.

So, the average headcount of an individual entrepreneur without employees could include the entrepreneur himself, but this contradicts the following logical conclusions based on the analysis of legislative acts:

- an entrepreneur cannot conclude an employment contract with himself, and according to the instructions of Rosstat, information is submitted about those employees with whom such a contract is concluded;

- in accordance with Art. 2 of the Civil Code of the Russian Federation An entrepreneur organizes his own business, a business at his own peril and risk, the purpose of his activities is to make a profit, and he has the right to act on his own behalf when concluding transactions and in court. Such activity cannot be classified as labor.

Categories of employees that are not included in the SSC

The following are not included in the calculation of the MSS:

- external part-time workers;

- specialists performing work and providing services under a civil contract;

- lawyers and some other categories.

Answers to frequently asked questions (repetition is the mother of learning)

- Should an individual entrepreneur without employees submit the average number of employees?

No, this obligation has been abolished by the legislator. Reporting from individual entrepreneurs “Average headcount without employees” for 2019 is not accepted.

- As this form was previously filled out, taking into account the fact that employees at the time of submission to staffing table wasn't listed?

A certificate of the average number of individual entrepreneurs without employees in this case was filled out according to the general rules.

- Is a zero value allowed?

Yes, if there were no employees on staff during the reporting period, this is quite logical - but not for individual entrepreneurs. Currently, LLCs without employees are still required to submit such forms.

- What to do if employees were on staff, but have now been fired?

The calculation of the value in the form must be made taking into account the established rules set out in the instructions of Rosstat. After all, the final value is the sum of the values calculated for each month. Thus, if employees worked at the enterprise during the period specified in the form, this should be reflected in the final figure. At the same time, the calculation rules are specific and spelled out in detail, there are special instructions to account for part-time workers, part-time workers, etc.

- How can we calculate the average number of employees?

We wrote in detail about the formula by which the calculation is made in the article “Sample for calculating the SSC” on our portal.

What if the individual entrepreneur still had employees?

The Federal Tax Service of Russia, as a state regulatory body, requires various reports from individual entrepreneurs in order to analyze general situation in areas of activity related to the functioning of individual entrepreneurs. Such documentation also includes a report on the average headcount, failure to submit which entails the imposition of penalties on the entrepreneur by the tax authorities. In the article we will look at how the average number of individual entrepreneurs is determined, what is the calculation formula for individual entrepreneurs with and without employees.

The essence of the average number of personnel

The essence of the average headcount is that the average number of all employees for the previous calendar year is calculated. This indicator is necessary for the tax authorities in order to understand what kind of document flow should be organized with the entrepreneur - electronic or paper. Let us remind you that if the average number of employees exceeds 25 people, then the organization is obliged to submit all reports and conduct correspondence with regulatory authorities only in electronic form through specialized telecommunication channels.

In addition to the annual deadline, a report on the average headcount must be submitted when creating or reorganizing a company no later than the 20th day of the month following the month in which the corresponding changes occurred. But this only applies to LLCs, when the entry is about new information entered into the Unified State Register of Legal Entities. There is no such obligation for individual entrepreneurs, that is, even when making an entry in the Unified State Register of Individual Entrepreneurs, they are not required to submit a report on the average number of employees.

Video reference “Calculation of the average number of personnel of various personnel”

Video training on calculating the average number of employees working at different conditions: under an employment contract, part-time, seasonal, etc. The lesson is taught by a teacher from the website “Accounting and Tax Accounting for Dummies”, Chief Accountant Gandeva N.V. To watch the lesson online, click on the video below ⇓

Features for individual entrepreneurs: average headcount with and without employees

Until 2014, all individual entrepreneurs were required to submit to the tax authorities information on the average number of employees hired to perform any job duties. Since 2014, this obligation has been abolished at the legislative level ( Art.80 Tax Code RF). Thus, only those individual entrepreneurs who have hired employees on the basis of employment contracts are required to submit information.

If, for example, an entrepreneur uses the labor of his family members without registering labor relations, then these people are not used to calculate the average number. In this case, if there are no hired employees, reporting for delivery is not required.

So, if the activity is registered as an individual entrepreneurship, you need to remember the following points:

Submission of information on the average headcount for individual entrepreneurs

Information is submitted to the tax authorities at the place of registration of the individual entrepreneur by drawing up and submitting a report on the average headcount, which is compiled according to a special form. It was approved by order of the Federal Tax Service of Russia, and, in addition, there is a developed and officially approved procedure for filling out the document form. The report must be submitted by January 20th next year which follows the reporting year, or before the 20th day of the month following the month in which the organization was created. If the number of employees exceeds 25 people, the report should be submitted to the tax authorities only through telecommunication channels, but not on paper.

In the case where reporting can be submitted on paper, it is necessary to provide two copies of the document: one for the tax service, the second for the entrepreneur. On the copy belonging to the individual entrepreneur, the tax official puts a mark of acceptance with the obligatory indication of the date of receipt of the document and the name of the employee who accepted it.

Responsibility for failure to provide information

The report on the average headcount must be submitted to the tax authorities for processing and verification, otherwise the organization and its officials penalties apply. They are as follows:

| Guilty subject | Administrative sanction |

| Legal entity (tax agent) – unintentional failure to submit | In case of violation, it is provided penalty in the amount of 200 rubles. for each document not submitted |

| Legal entity (tax agent) – unintentional submission of false information | In case of violation, a fine of 500 rubles is provided. for each erroneous document |

| Official – failure to submit documents or submission with incorrect information | In case of violation, a fine is provided in the amount of 300 to 500 rubles. for each document not submitted or erroneous |

Formulas for calculating the average number of employees

Calculating the average headcount of an organization is not very complicated; however, it sometimes causes some difficulties. To do this, let's look at a calculation example in more detail.

The average number of employees for a calendar year is calculated based on the average number of employees for calendar months. In this case, it is necessary to sum up the 12 obtained indicators and divide by 12, that is:

Average average (year) = [ Average average (January) + Average average (February) + Average average (March) + Average average (April) + Average average (May) + Average average (June) + Average average (July) + Average average (August) + Average average (September) + Average average (October) + Average average (November) + Average average (December) ] / 12

As for the average headcount for the month, it is calculated by summing up all employees who fully worked for the entire month and dividing the result by the number of calendar days. The calculation looks like this:

Average cost (month) = the sum of all employees who worked fully for the month / number of calendar days

Even if some employees were in annual leave, on a business trip or were sick, they still need to be taken into account, since they are on the staff of the organization. Those employees who are external part-time workers those on parental leave, on leave at their own expense, those registered under civil law contracts, those sent for off-the-job training and scholarships, as well as the individual entrepreneur himself.

When calculating the average number of employees, in most cases, a fractional result is obtained, which must be rounded to a whole number. This is done according to the rules of mathematics:

- decimal places of 5 or more are rounded to big side with the addition of a whole unit;

- decimal places of 4 and less are rounded down without adding a whole unit.

If the organization has employees who work at more than one rate, for example, 1.25 or 1.5, they must be counted as one person, that is, 1 is taken into account for the calculation. For part-time employees, they are counted in proportion to the time they work. In this case, the following calculation of the average number of employees working part-time is made:

Average working hours (part-time work per month) = number of person-hours worked / duration working day/ number of working days of the month

The length of the working day can also be different for enterprises: a 40-hour week or an 8-hour working day is considered standard, but there can also be a 20-hour week and a 4-hour working day, etc.

In the case when, for some reason, an individual entrepreneur did not carry out production activities, for these months the average number of employees is taken equal to 0.

Automation of accounting

You can calculate the average headcount yourself using the presented formula, but for greater accuracy it is better to use automated system accounting. As a rule, accounting is carried out on the basis of software, which includes the function of personnel accounting. With its help, you can get a more accurate calculation, which will not be questioned by the tax authorities. But if an individual entrepreneur employs only a few employees, there is no point in purchasing expensive equipment specifically for generating a report. software- You can completely cope with this task yourself.

An example of calculating the average number of employees

IP Kharitonov D.V. has on its staff: 70 people, one of whom was on vacation for a full month in May, the second is on maternity leave all year, the third was on a business trip for the entire month in October, the fourth took vacation for his work in November monthly invoice.

The average number of employees for the entire year is calculated as follows:

Average (January, February, March, April, June, July, August, September, December) = (70 – 1) * 9 = 621 – people on parental leave are not taken into account

Average average (May) = 70 – 1 = 69 – a person on annual leave is taken into account

Average average (October) = 70 – 1 = 69 – a person on a business trip is taken into account

Average average (November) = 70 – 1 – 1 = 68 – a person on vacation at his own expense is not taken into account

Summarizing the results obtained, we calculate the average number of employees for the year:

Average cost (year) = (69 * 11 + 68) / 12 = 68.92

By rounding we find that the average number of employees in individual entrepreneur D.V. Kharitonov per year is 69 people.

Blitz answers to 4 frequently asked questions about the average headcount

Question No. 1. If an individual entrepreneur does not have employees, is it necessary to submit information about the average number of employees?

Information on the average payroll number for an individual entrepreneur must be submitted only if he is registered as an employer, that is, uses hired labor individuals. If an individual entrepreneur does not have hired employees, he is not required to submit a report on the average number of employees to the tax authorities.

Although the law directly states that individual entrepreneurs who do not hire employees are not required to submit a report on average payroll activities, it may make sense to submit a zero report or find out in detail at tax office. The fact is that some individual entrepreneurs note the following fact: they did not submit the report due to the absence of employees, and the tax authorities fined them for failure to submit documents. All this entails litigation, so you need to make sure in advance with the tax office that it is not necessary to submit a report or submit it with zero columns.

Question No. 2. If over the past year reporting period The average number of employees has not changed, do I need to submit the report again?

Yes, the report is required to be submitted for each year, even if the information in two consecutive reports has not changed.

Question No. 3. What will happen to us if we forgot to submit a report on the average headcount?